Nursing Homes Covered by Medicare: Top 5 Essential Insights

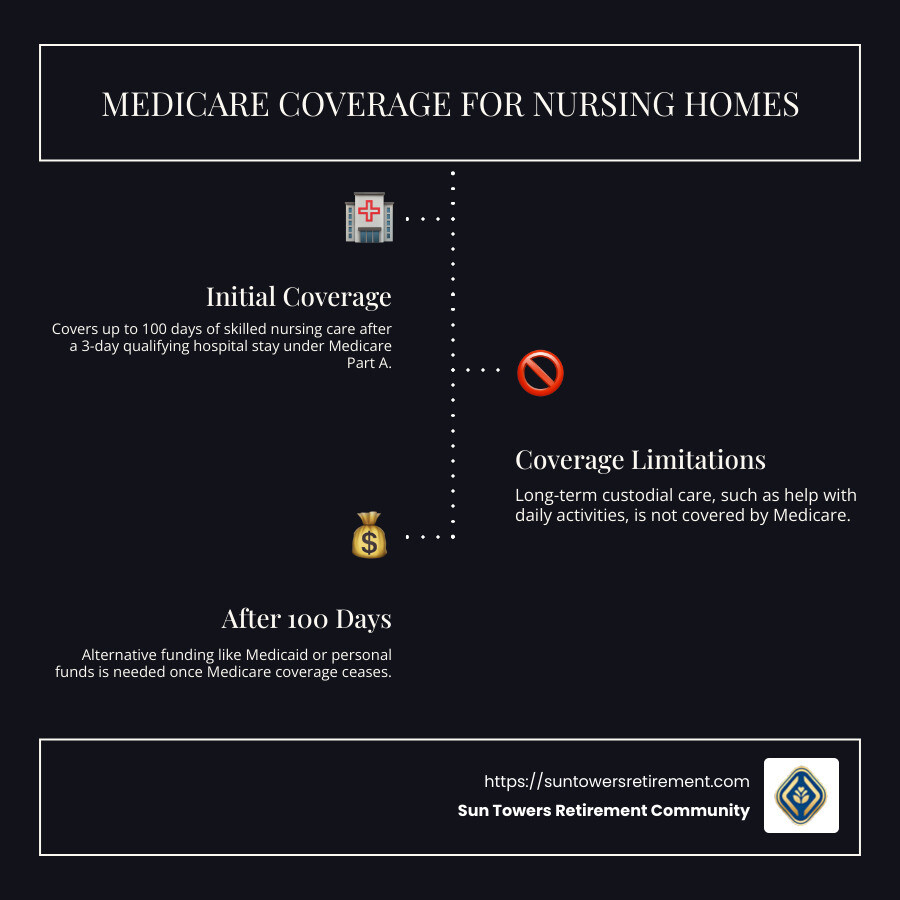

Nursing homes covered by Medicare is a topic often shrouded in confusion and concern, especially for aging individuals seeking seamless care transitions. To quickly clarify, Medicare provides very limited coverage for nursing home costs, focusing mainly on short-term stays in skilled nursing facilities after a qualifying hospital admission. Here’s a brief overview to help you understand what Medicare covers:

- Medicare Part A generally covers up to 100 days of skilled nursing care, following a hospital stay of at least three days.

- Long-term custodial care, which includes assistance with daily activities like bathing and eating, is not covered by Medicare.

- After 100 days, coverage ceases, and alternative funding sources like Medicaid or personal funds become necessary.

Understanding these basics is crucial, especially as the average cost of long-term care continues to rise, highlighting the importance of careful planning and exploration of various payment options.

Nursing homes covered by medicare terms to know:

– assisted living vs nursing home

– nursing care facility

– skilled nursing facilities

What is Medicare?

Medicare is a federally funded health insurance program designed primarily for people aged 65 and older, though it also covers some younger individuals with disabilities or specific conditions. The program is divided into different parts, each covering various healthcare services.

Key Features of Medicare

1. Federally Funded:

Medicare is a national program, meaning it’s funded by the federal government. This ensures that coverage is consistent across all states, providing a safety net for millions of Americans as they age.

2. Health Insurance:

Medicare covers hospital stays, doctor visits, and other medical services. It consists of several parts:

- Part A: Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Part B: Covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Part D: Offers prescription drug coverage.

3. Eligibility:

To qualify for Medicare, most people must be 65 or older. However, younger individuals can also be eligible if they have certain disabilities or conditions, such as End-Stage Renal Disease.

Enrollment Process

Initial Enrollment Period (IEP):

- Begins three months before you turn 65 and ends three months after your 65th birthday month.

- It’s crucial to enroll during this period to avoid late enrollment penalties.

Special Enrollment Period (SEP):

- Available for those who didn’t sign up during their IEP because they were covered by a group health plan through their job or their spouse’s job.

Understanding Medicare is essential for making informed decisions about your healthcare needs, especially when considering options like skilled nursing facilities. It’s not just about knowing what’s covered but also about planning for what isn’t, such as long-term custodial care.

Nursing Homes and Medicare Coverage

When it comes to nursing homes covered by Medicare, it’s important to understand the distinction between nursing homes and skilled nursing facilities (SNFs). These terms often get mixed up but serve different roles in healthcare.

Nursing Homes vs. Skilled Nursing Facilities

Nursing Homes provide long-term care for individuals who need help with daily activities like bathing, dressing, and eating. This care is largely custodial, meaning it focuses on helping residents with everyday tasks rather than medical treatments. Medicare does not cover this type of care if it’s the only service you need.

Skilled Nursing Facilities, on the other hand, offer short-term, medically necessary care by licensed professionals, such as registered nurses and therapists. This care is often required after a hospital stay due to illness, injury, or surgery.

Medicare Part A and Skilled Nursing Care

Medicare Part A can help cover the costs of care in a skilled nursing facility, but there are specific conditions that must be met:

-

Qualifying Hospital Stay: You must have a prior hospital stay of at least three days as an inpatient. This is crucial for Medicare to cover SNF care.

-

Timeframe: You need to enter the SNF within a short period (usually 30 days) after being released from the hospital.

-

Medical Necessity: A healthcare provider must certify that you need daily skilled care, which can include services like physical therapy or wound care.

-

Medicare-Certified Facility: The facility must be certified by Medicare to provide skilled nursing care.

Coverage Details

If all conditions are met, Medicare Part A covers:

- The first 20 days in a skilled nursing facility completely.

- Days 21 through 100 with a daily coinsurance fee.

After 100 days, Medicare stops covering SNF care, and you’ll need to explore other payment options if further care is required. This limitation underscores the importance of understanding what Medicare covers and planning for additional expenses.

In summary, while Medicare Part A offers significant support for short-term skilled nursing care, it doesn’t cover long-term care in nursing homes. Knowing the difference between nursing homes and skilled nursing facilities is key to navigating Medicare coverage effectively.

Nursing Homes Covered by Medicare

Understanding the specifics of nursing homes covered by Medicare is crucial for planning care needs. Medicare doesn’t cover long-term stays in nursing homes, but it does cover short-term skilled care in certain situations.

Short-Term Care and Qualifying Hospital Stay

Medicare Part A is your friend when it comes to short-term care in a skilled nursing facility (SNF). But, there are important criteria to meet:

-

Qualifying Hospital Stay: Before Medicare covers SNF care, you need to have been admitted to a hospital as an inpatient for at least three consecutive days. Outpatient or observation days do not count.

-

Timing is Everything: You must enter the SNF within 30 days of leaving the hospital. This ensures the care you’re receiving is directly related to your recent hospital stay.

-

Skilled Care Requirement: Your doctor must confirm that you need daily skilled care. This could be anything from physical therapy to specialized wound treatment.

What Medicare Covers

When you meet the above conditions, Medicare Part A steps in to help with costs:

- Days 1-20: Medicare covers 100% of the costs in a Medicare-certified SNF.

- Days 21-100: You will be responsible for a daily coinsurance fee. In 2024, this fee is $209.50 per day.

- Beyond 100 Days: Medicare coverage ends, and you’ll need other payment methods for continued care.

Skilled Care in Action

Imagine recovering from a hip surgery. After your hospital stay, you might need help from experts like physical therapists to regain mobility. This is where skilled nursing facilities shine. They offer the specialized care you need to get back on your feet, all under Medicare’s watchful eye, but only for a limited time.

In conclusion, while Medicare helps with short-term, medically necessary care in skilled nursing facilities, it doesn’t cover long-term nursing home stays. Knowing these details can help you plan and manage healthcare expenses effectively.

Costs and Payment Options

When it comes to paying for nursing home care, understanding your options can make a big difference. Let’s break down the various routes you can take.

Medicare Advantage Plans

Medicare Advantage plans, also known as Part C, are private health plans that provide at least the same benefits as Original Medicare. These plans often offer additional benefits, but not all Medicare Advantage plans cover the same nursing home services.

- Varied Coverage: Some plans might require a copay for the first 20 days of a nursing home stay, while others may cover more.

- Check Your Plan: Always verify with your Medicare Advantage provider to know exactly what your plan covers.

Medigap (Medicare Supplement Insurance)

Medigap policies are designed to help cover some of the costs not included in Original Medicare, such as coinsurance and deductibles.

- Coinsurance Help: Many Medigap plans cover coinsurance for days 21 through 100 in a skilled nursing facility, which can save you from significant out-of-pocket expenses.

- Plan Variability: Different Medigap policies offer different levels of coverage, so it’s important to review your policy details carefully.

Out-of-Pocket Costs

Even with Medicare, there are some costs that you’ll need to cover yourself.

- Coinsurance for Days 21-100: After the first 20 days in a skilled nursing facility, you’ll pay a daily coinsurance fee. For 2024, this fee is $209.50 per day.

- Beyond 100 Days: Medicare coverage stops after 100 days, leaving you to explore other payment options like Medicaid, long-term care insurance, or personal savings.

Navigating Financial Choices

It’s essential to be proactive in understanding these costs and exploring all available options. Whether it’s through Medicare Advantage, Medigap, or other means, knowing how to manage these expenses can help you make informed decisions about your healthcare needs.

Frequently Asked Questions about Medicare and Nursing Homes

Does Medicare cover long-term nursing home care?

No, Medicare does not cover long-term nursing home care. Medicare is designed to cover medical care, not custodial or long-term care. Custodial care includes help with daily activities like bathing, dressing, and eating. These are considered non-medical services and, therefore, are not covered by Medicare. If a loved one needs long-term care, you’ll need to explore other options such as Medicaid, which may offer more support for long-term care needs.

How long does Medicare cover nursing home care?

Medicare covers nursing home care only for a short period. This is usually limited to 100 days per benefit period in a skilled nursing facility.

- First 20 Days: Medicare covers the full cost.

- Days 21-100: You’ll pay a daily coinsurance. In 2024, this amounts to $209.50 per day.

- Beyond 100 Days: Medicare coverage stops, and you must find other ways to pay.

A benefit period starts when you’re admitted to a hospital or skilled nursing facility and ends after you haven’t received any inpatient care for 60 days in a row.

What happens when Medicare stops paying for nursing home care?

When Medicare coverage ends after 100 days, you’ll need to consider alternative payment options. Here are a few:

- Medicaid: This program might cover long-term care costs if you meet certain financial criteria. It’s a joint federal and state program designed to help low-income individuals.

- Private Assets: Some people use their savings, retirement funds, or investments to pay for ongoing care.

- Long-Term Care Insurance: If you have this type of insurance, it can help cover costs not paid by Medicare.

- Family Support: In some cases, family members may contribute financially to help cover costs.

Planning ahead is crucial. Understanding these options can help you manage the financial challenges of long-term care effectively.

Conclusion

At Sun Towers Retirement Community, we believe in providing a continuum of care that allows residents to age gracefully and comfortably. Our community in Sun City Center, FL, offers a range of living options, including Independent Living, Assisted Living, Memory Care, and Skilled Nursing. This variety ensures that as your needs change, your home doesn’t have to.

Aging in place is about more than just staying in one location; it’s about maintaining your quality of life and independence. At Sun Towers, you can enjoy your retirement on your terms, knowing that support is available if and when you need it. Our skilled nursing facilities offer short-term care that aligns with Medicare’s coverage, ensuring that you receive the necessary medical support following a hospital stay.

While Medicare does not cover long-term custodial care, our community provides options that can adapt to your evolving needs. We are here to help you explore all available resources, including potential Medicaid support, long-term care insurance, and other financial options.

By choosing Sun Towers, you are choosing a community that respects your desire for independence while offering the peace of mind that comes with knowing you have a plan for the future. With us, you’re not just living; you’re thriving.

For more information on our skilled nursing services, explore our offerings. We’re here to support you every step of the way.