Medicare Rehabilitation Coverage: Top Guide for 2025

Open uping the Secrets of Medicare Rehabilitation Coverage

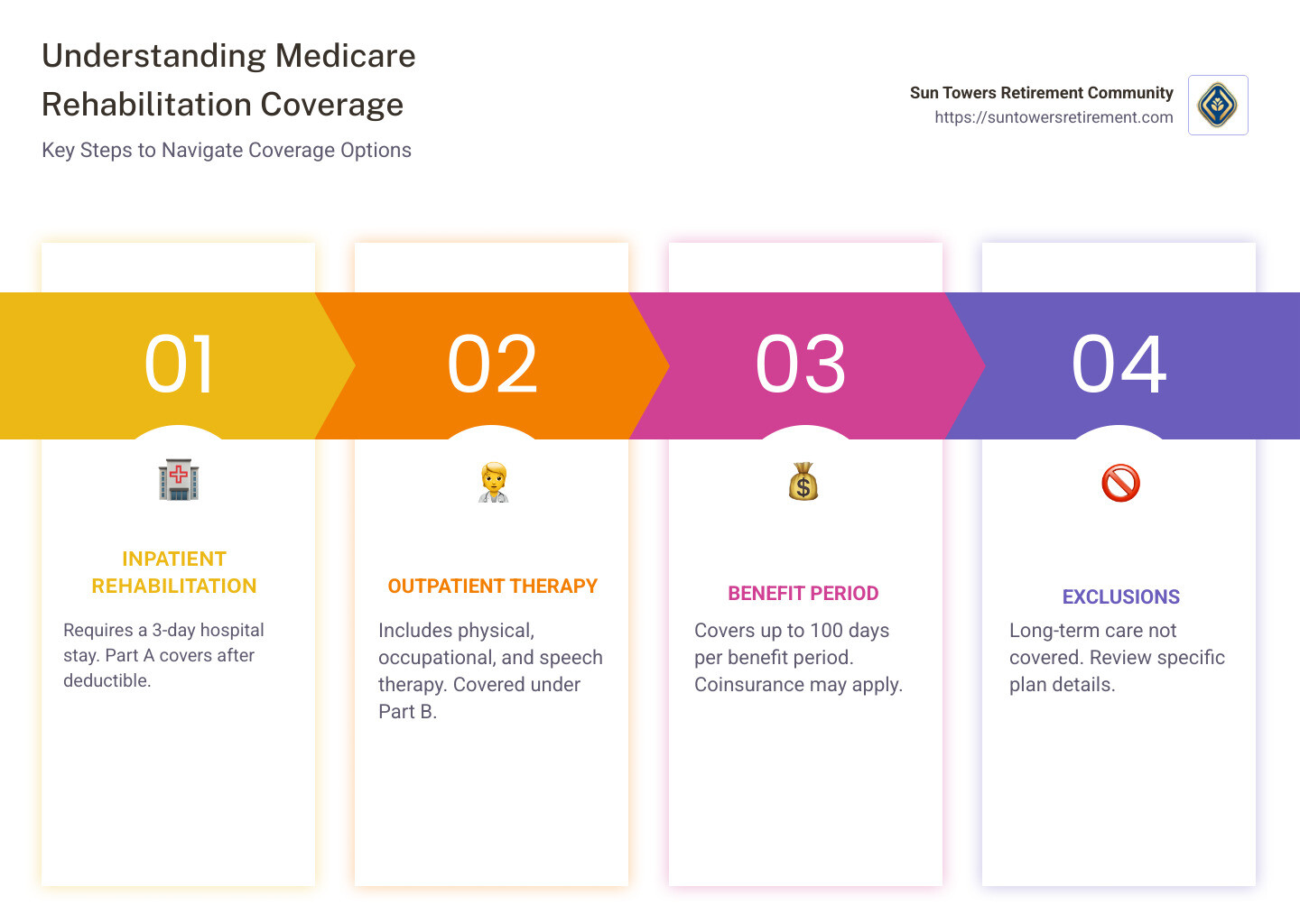

If you’re curious about medicare rehabilitation coverage, here’s a quick snapshot to get you started:

- Medicare covers inpatient rehabilitation after a 3-day hospital stay.

- Outpatient rehab and physical therapy are covered under Part B.

- Long-term care isn’t usually covered by Medicare.

In senior healthcare, understanding the nuances of Medicare rehabilitation coverage is crucial. Seniors often need rehabilitation services to regain strength, mobility, and independence after medical events like surgery or illness. However, knowing what Medicare will cover can seem daunting.

Medicare is designed to aid in your recovery journey, but grasp the finer points of this coverage to avoid unexpected costs. Whether you’re considering inpatient or outpatient rehab, Medicaire provides differing levels of support.

Navigating this landscape can be simpler when you have the right information, making recovery more accessible and less stressful.

Explore more about medicare rehabilitation coverage:

– how much does medicare pay for physical therapy per visit

– what is rehabilitation therapy

– outpatient therapies

Understanding Medicare Rehabilitation Coverage

When it comes to Medicare rehabilitation coverage, it’s important to know the roles of Medicare Part A and Medicare Part B. These two parts of Medicare provide different types of coverage for rehabilitation services, whether you’re staying in a facility or visiting for outpatient therapy.

Medicare Part A: Inpatient Rehabilitation

Medicare Part A covers inpatient rehabilitation services. This usually means you’ll be staying in a facility like a hospital or a skilled nursing facility (SNF) where you receive intensive rehabilitation care. To qualify, you generally need a 3-day hospital stay first. This is known as the “3-day rule.”

Once admitted, Medicare Part A covers services such as:

- Skilled therapy (physical, occupational, speech/language)

- Semi-private room and meals

- Nursing and prescription medications

Medicare Part B: Outpatient Rehabilitation

Medicare Part B handles outpatient rehabilitation services. This includes therapies you might receive at a clinic or doctor’s office without staying overnight. Part B covers:

- Physical therapy

- Occupational therapy

- Speech-language pathology

You’ll need to meet a $240 deductible for outpatient services, and you’ll be responsible for 20% of the costs as coinsurance.

Inpatient vs. Outpatient: What’s the Difference?

The key difference between inpatient and outpatient rehabilitation lies in the intensity and setting of the care you receive. Inpatient rehabilitation is more intensive and requires a stay at a facility, while outpatient therapy is typically less intensive and allows you to return home after each session.

Understanding these distinctions in Medicare rehabilitation coverage can help you or your loved ones plan for recovery without unexpected financial surprises. Stay informed and ask your healthcare provider to clarify any doubts about your coverage needs.

In the next section, we’ll dive deeper into the specifics of inpatient rehabilitation facilities and the qualifying conditions for coverage.

Inpatient Rehabilitation Facilities (IRF)

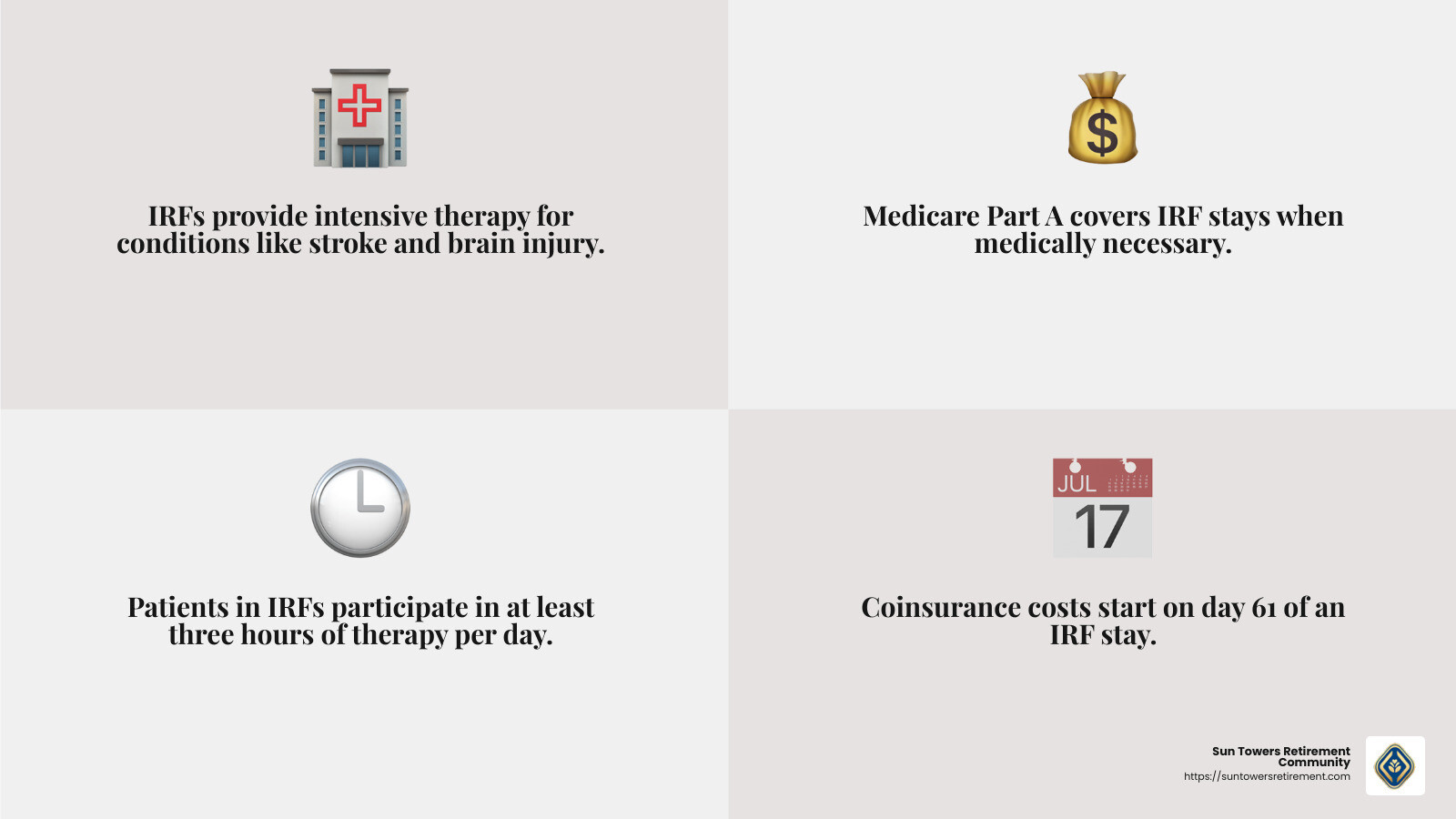

Inpatient Rehabilitation Facilities, or IRFs, are specialized centers that offer intensive rehab to help patients recover from serious medical events. These facilities are crucial for those who need a high level of care and supervision from a coordinated team of healthcare professionals.

What Qualifies You for an IRF?

To be eligible for care in an IRF, your doctor must confirm that your medical condition requires:

- Intensive rehabilitation: This means you need multiple therapy sessions daily, such as physical, occupational, or speech therapy.

- Continued medical supervision: Regular monitoring by doctors and nurses is necessary to manage your recovery.

- Coordinated care: A team approach where doctors, nurses, and therapists work together to create a personalized treatment plan.

Common conditions that often require an IRF include:

- Stroke

- Spinal cord injury

- Brain injury

- Orthopedic surgery

Skilled Nursing Facilities (SNFs) vs. IRFs

While both Skilled Nursing Facilities (SNFs) and IRFs provide inpatient care, there are key differences.

- Intensity of Care: IRFs offer more intensive therapy compared to SNFs. Patients in IRFs typically participate in at least three hours of therapy per day.

- Qualification Criteria: SNFs might be suitable for less intensive rehabilitation needs and often follow a hospital stay where the 3-day rule applies.

- Type of Care: SNFs often focus on helping patients with daily living activities, while IRFs focus on rehabilitation to improve function and independence.

Navigating Medicare Coverage for IRFs

Medicare Part A covers stays in an IRF when deemed medically necessary. However, understanding the financial aspects is crucial:

- Benefit Period: Coverage includes the first 60 days after meeting the Part A deductible.

- Coinsurance: Starts on day 61. Knowing these costs helps in planning financially for your stay.

IRFs play a vital role in recovery, offering a structured environment where patients can regain their independence and quality of life. Next, we’ll explore the specifics of coverage details and costs associated with these facilities.

Coverage Details and Costs

When it comes to Medicare rehabilitation coverage, understanding the details can make all the difference in managing your healthcare expenses. Let’s break down the key components: benefit period, deductible, coinsurance, and lifetime reserve days.

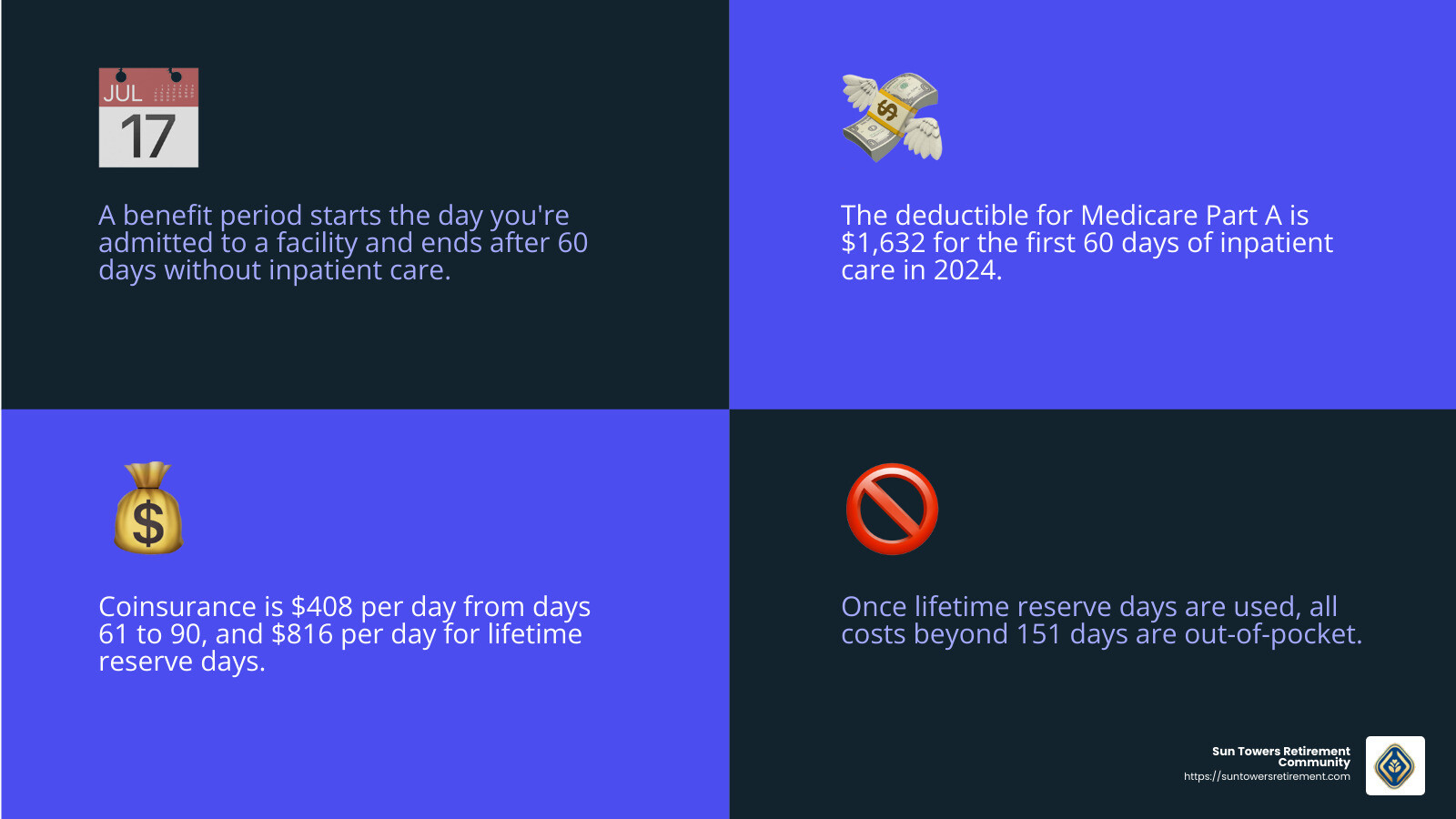

Benefit Period

A benefit period starts the day you’re admitted to a hospital or an inpatient rehabilitation facility (IRF) and ends when you haven’t received any inpatient care for 60 days in a row. This period is crucial because it determines your coverage limits and resets your deductible.

Deductible

For 2024, the deductible for Medicare Part A is $1,632 for the first 60 days of inpatient care. This means you must pay this amount out-of-pocket before Medicare starts covering your stay. If you’re transferred to an IRF directly from a hospital, and you’ve already met this deductible, you won’t need to pay it again for the same benefit period.

Coinsurance

Coinsurance is the part of the cost that you pay once your deductible is met. For days 61 to 90 in an IRF, you’ll pay $408 per day. If your stay extends beyond 90 days, you’ll enter lifetime reserve days, during which you’ll pay $816 per day for up to 60 additional days. Once these are used, you cover all costs beyond 151 days.

Lifetime Reserve Days

These are a safety net of 60 extra days that you can use over your lifetime when you need more than 90 days of inpatient care in a benefit period. It’s important to use these wisely, as they don’t renew.

Planning your healthcare expenses can be daunting, but knowing these details helps you steer Medicare rehabilitation coverage with confidence. Next, we’ll dive into outpatient rehabilitation services and how they fit into your recovery plan.

Outpatient Rehabilitation Services

When it comes to outpatient rehabilitation services, Medicare Part B is your go-to. These services are vital for many who need help but don’t require an inpatient stay. Let’s break down the main types of outpatient rehab services covered: physical therapy, occupational therapy, and speech-language pathology.

Physical Therapy

Physical therapy is all about improving your movement and strength. Whether you’re recovering from surgery or dealing with a chronic condition, physical therapy can help you regain mobility. Therapists use exercises, stretches, and other techniques to help decrease pain and swelling, rebuild strength, and improve your range of motion.

Occupational Therapy

Occupational therapy is focused on helping you perform daily activities. If you’re recovering from an injury or adapting to a physical change, occupational therapists teach you how to use medical devices and perform tasks like dressing or cooking. They aim to prepare you for life at home and ensure you can be as independent as possible.

Speech-Language Pathology

Speech-language pathology helps with communication and swallowing issues. This therapy is crucial if you’ve had a stroke or other condition affecting your ability to speak or swallow. Therapists work with you to rebuild vocabulary, practice word retrieval, and learn new communication methods. They also help with swallowing food and drinks safely.

Costs and Coverage

Medicare Part B covers these outpatient services if they are medically necessary. However, you’ll need to pay a 20% coinsurance after meeting your Part B deductible, which is $240 for 2024. It’s important to discuss your treatment plan with your doctor to understand what Medicare will cover and what you’ll need to pay out-of-pocket.

Understanding Medicare rehabilitation coverage for outpatient services can help you make informed decisions about your care. These therapies are essential components of a comprehensive recovery plan, whether you’re recovering from a hospital stay or managing a chronic condition.

Next, we’ll answer some frequently asked questions about Medicare rehabilitation coverage, including what kind of rehab Medicare covers and how many days are included.

Frequently Asked Questions about Medicare Rehabilitation Coverage

What kind of rehab does Medicare cover?

Medicare covers several types of rehabilitation, all aimed at helping you recover and regain independence. Here’s what you need to know:

Inpatient Rehab: This is for those who need intensive care after a serious event like a stroke or spinal cord injury. It usually takes place in an Inpatient Rehabilitation Facility (IRF) and requires a doctor’s certification that intensive rehab is necessary. Medicare Part A covers this if you meet specific criteria, such as requiring coordinated care from doctors and therapists.

Skilled Nursing Facility (SNF) Rehab: After a qualifying hospital stay of at least three days, you might need rehab in a skilled nursing facility. This is often needed after surgeries like hip or knee replacements. Medicare Part A covers up to 100 days in an SNF, with specific costs for different periods.

Outpatient Therapy: If you don’t need to stay overnight in a facility, outpatient therapy might be right for you. Medicare Part B covers physical therapy, occupational therapy, and speech-language pathology if they are medically necessary.

How many days of rehab will Medicare pay for?

Medicare’s coverage for rehab days varies based on the type of facility:

Skilled Nursing Facility (SNF): Medicare covers up to 100 days per benefit period. The first 20 days are fully covered after meeting the Part A deductible. From day 21 to 100, you’ll pay a daily coinsurance. After day 100, Medicare does not cover costs, so you’ll be responsible for all charges.

Inpatient Rehabilitation Facility (IRF): Here, Medicare covers the first 60 days after the Part A deductible. From days 61 to 90, you pay a daily coinsurance. If you need more time, you can use up to 60 lifetime reserve days, with a higher coinsurance. Beyond day 150, all costs are out-of-pocket.

What is the 60% rule in rehab?

The 60% rule is a Medicare facility criterion for inpatient rehabilitation facilities (IRFs). It requires that at least 60% of the patients in an IRF have one of 13 qualifying conditions, such as stroke, brain injury, or spinal cord injury. This rule ensures that IRFs focus on patients who need intensive rehabilitation.

Understanding these aspects of Medicare rehabilitation coverage can help you steer your options and make informed choices about your care. Whether it’s inpatient or outpatient rehab, knowing what Medicare covers and for how long can alleviate stress and help you focus on recovery.

Next, we’ll wrap up with how Sun Towers Retirement Community supports your journey through rehabilitation and beyond.

Conclusion

At Sun Towers Retirement Community, we are committed to supporting your journey through rehabilitation and beyond, ensuring you have access to the care you need. Our continuum of care approach allows residents to “Age in Place,” providing a seamless transition between different levels of care as your needs change. This means you can move from independent living to assisted living, memory care, or skilled nursing without leaving your community.

Understanding Medicare coverage is crucial in making informed decisions about your rehabilitation options. Medicare offers coverage for various types of rehab, both inpatient and outpatient, to help you regain your independence and quality of life. Whether you require intensive rehab in an Inpatient Rehabilitation Facility (IRF) or outpatient therapy, knowing what Medicare covers can ease financial concerns and let you focus on healing.

At Sun Towers, we offer a variety of therapy services to meet your rehabilitation needs. From physical therapy to speech-language pathology, our skilled professionals are here to support you every step of the way.

Explore our therapy services to learn more about how we can assist you in your rehabilitation journey.

By choosing Sun Towers Retirement Community, you’re not just selecting a place to live; you’re choosing a community dedicated to your health, well-being, and peace of mind. Let us be your partner in navigating rehabilitation and Medicare coverage, ensuring you receive the best care possible.