Healthcare for seniors: Top 7 Essential Tips 2025

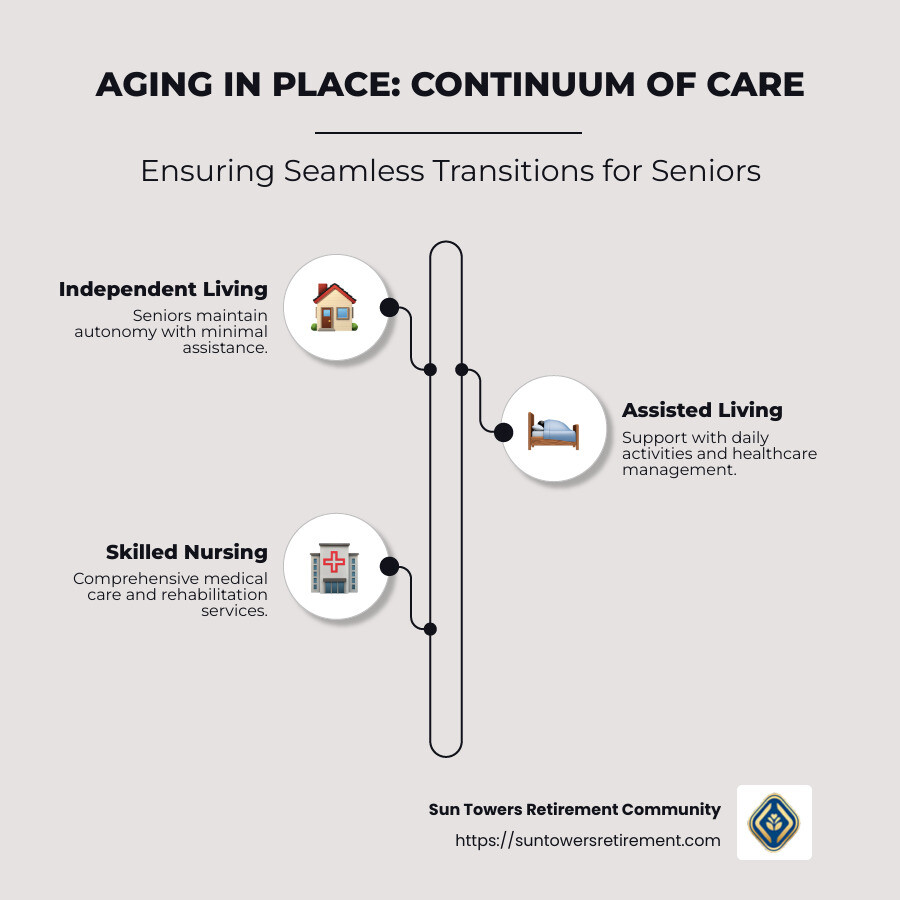

Healthcare for seniors is critically important as it encompasses a range of services aimed at ensuring a healthy and active lifestyle for aging individuals. At Sun Towers Retirement Community, we focus on providing a comprehensive continuum of care, ensuring our residents can age in place with security and ease. This approach allows seniors to enjoy various levels of care, from independent living to skilled nursing, all within one vibrant community.

- Aging in place supports independence and comfort

- Continuum of care offers seamless transitions between care levels

- Comprehensive healthcare options available within the community

Our mission is to address common concerns like the fear of losing independence and the need for comprehensive care options, all while fostering a vibrant, engaging environment. By integrating premium healthcare services with community living, we empower seniors to thrive physically, mentally, and emotionally.

Understanding Healthcare for Seniors

Navigating healthcare for seniors can be a complex journey, but understanding the basics of Medicare and Medicaid is a great starting point. These programs are the backbone of senior healthcare in the United States, providing essential services to millions of older adults.

Medicare: The Basics

Medicare is a federal health insurance program primarily for people aged 65 and older. It has four parts:

- Part A covers hospitalization costs.

- Part B includes physician services, outpatient care, and some preventive services.

- Part C refers to Medicare Advantage Plans, which are offered by private companies and include the benefits of Parts A and B, often with added services.

- Part D helps cover the cost of prescription drugs.

Each part plays a crucial role in ensuring seniors have access to necessary medical services.

Medicaid and Dual Eligibility

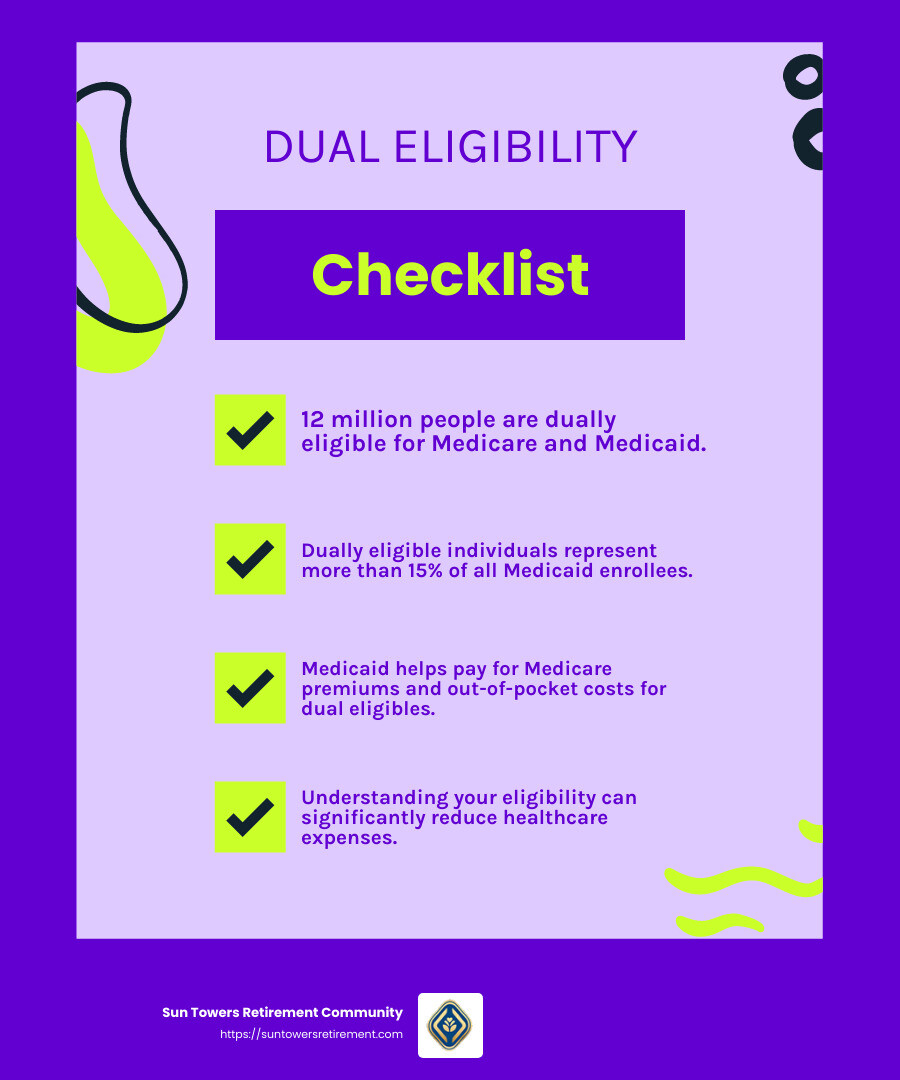

Medicaid is a joint federal and state program that provides health coverage to low-income individuals, including seniors. Some seniors are “dually eligible,” meaning they qualify for both Medicaid and Medicare. This dual eligibility can offer significant financial relief by covering expenses that Medicare may not, such as long-term nursing care and additional prescription costs.

In fact, 12 million people are dually eligible, representing more than 15% of all Medicaid enrollees. This dual coverage ensures that seniors with limited income and resources can access a broader range of services without overwhelming financial burdens.

Income Limits and Assistance

Understanding income limits is essential for determining eligibility for programs like Medicaid. For instance, the Qualified Medicare Beneficiary (QMB) program helps pay for Medicare premiums and out-of-pocket costs for those with an income at or below 100% of the Federal Poverty Level (FPL). Other programs like Specified Low-Income Medicare Beneficiary (SLMB) and Qualifying Individual (QI) offer similar support with slightly higher income thresholds.

By knowing these limits, seniors and their families can better plan for healthcare expenses and explore available assistance programs.

In summary, Medicare and Medicaid are vital to senior healthcare, offering a safety net that helps manage the costs of aging. Understanding these programs and the benefits of dual eligibility can make a significant difference in securing quality healthcare for seniors.

Medicare and Medicaid: What Seniors Need to Know

When it comes to healthcare for seniors, understanding Medicare and Medicaid is crucial. These programs provide essential coverage, but navigating them can be tricky. Let’s break down what seniors need to know about Medicare Parts A-D, Medicaid coverage, and income limits.

Medicare Parts A-D

Medicare Part A is your go-to for hospitalization costs. If you need to stay in a hospital or require skilled nursing care, Part A is what covers these expenses. Most people don’t pay a premium for Part A, as long as they’ve paid Medicare taxes for at least ten years.

Medicare Part B covers necessary medical services like doctor’s visits, lab tests, and preventive care. In 2025, the standard monthly premium for Part B is $185. However, if your income is over a certain amount, you might pay more.

Medicare Part C, also known as Medicare Advantage, is offered by private companies. These plans include everything in Parts A and B and often add extras like vision, hearing, and dental coverage. They usually have lower out-of-pocket costs but may require you to stay within a network of providers.

Medicare Part D helps with prescription drug costs. It’s optional, but many seniors find it necessary due to the high cost of medications.

Medicaid Coverage

Medicaid is designed for individuals with limited income, offering a lifeline for seniors who need help beyond what Medicare provides. This includes long-term nursing care, which Medicare only covers for a limited time. Medicaid also fills in the gaps for services like eyeglasses and hearing aids.

For those who qualify for both Medicare and Medicaid—known as “dually eligible” individuals—Medicaid can help pay for Medicare premiums and out-of-pocket costs. This dual eligibility is a big deal, as it can significantly reduce healthcare expenses.

Income Limits

Income limits play a significant role in determining eligibility for Medicaid and related programs. For instance, the Qualified Medicare Beneficiary (QMB) program assists those with income at or below 100% of the Federal Poverty Level (FPL). This program helps pay for Medicare premiums and other costs.

Other programs, like the Specified Low-Income Medicare Beneficiary (SLMB) and Qualifying Individual (QI), offer assistance for those with slightly higher incomes. These programs are essential for seniors who need extra help managing their healthcare expenses.

Understanding these income limits can help seniors and their families make informed decisions about healthcare options and financial planning.

In short, knowing the ins and outs of Medicare Parts A-D and Medicaid can make a world of difference in securing quality healthcare for seniors. By navigating these programs wisely, seniors can access the care they need without breaking the bank.

Supplemental Health Insurance for Seniors

While Medicare and Medicaid cover many healthcare needs, they often leave gaps that can lead to out-of-pocket costs. This is where supplemental health insurance steps in, offering additional coverage to help manage expenses.

Supplemental plans are designed to cover what primary insurance doesn’t. They can include coverage for dental, vision, and hearing services, which Medicare typically doesn’t cover. These plans can also help with co-pays, deductibles, and even prescription drug costs.

One popular option for supplemental insurance is to explore plans that are custom to the needs of seniors, such as critical illness, hospital indemnity, and cancer coverage. These plans can provide a financial safety net in case of unexpected health issues.

A key benefit of supplemental insurance is the ability to choose plans that fit specific needs. For example, if you’re concerned about potential hospital stays, a hospital indemnity plan can help cover those costs. If cancer runs in your family, a cancer insurance plan might be a wise choice.

The cost of supplemental insurance can vary based on factors like age, location, and the type of plan. As you age, premiums may increase, so it’s crucial to factor this into your budget.

To determine the best supplemental plan for your needs, consider speaking with a knowledgeable agent. They can help assess your healthcare needs and recommend plans that align with your financial situation.

In summary, supplemental health insurance can significantly ease the financial burden of healthcare for seniors. By filling in the gaps left by Medicare and Medicaid, these plans offer peace of mind and help ensure access to necessary care.

Affordable Healthcare Options for Seniors

Navigating affordable healthcare options for seniors can be challenging, but there are several programs designed to help. One standout program is PACE, or the Program of All-Inclusive Care for the Elderly. This program is a comprehensive care solution for seniors who wish to remain in their homes while receiving necessary healthcare services. PACE provides medical and social services, eliminating the need for nursing home care. It’s especially beneficial for low-income seniors, as it can significantly reduce healthcare costs.

For seniors with limited financial resources, low-income assistance programs can be a lifeline. Medicaid is a key player here, offering free or low-cost healthcare to eligible individuals. Eligibility requirements vary by state, so check local guidelines. Medicaid covers a variety of services, from hospital stays to home health care, and even some long-term care options.

Prescription drug costs can be a significant burden for seniors. Fortunately, prescription drug plans like Medicare Part D can help manage these expenses. Part D plans are run by private insurance companies and cover many common medications. While the costs of these plans can vary, they often include premiums, deductibles, and co-pays. It’s crucial to compare different plans to find one that fits your medication needs and budget.

Additionally, some states offer extra help programs for those struggling with prescription costs. These programs can provide additional savings on medications, making them more affordable for seniors on a fixed income.

In conclusion, seniors have several options to help manage healthcare costs. Whether through comprehensive programs like PACE, low-income assistance via Medicaid, or prescription drug plans, there are resources available to ensure seniors receive the care they need without breaking the bank.

Learn more about PACE and Medicaid.

Next, we will explore some frequently asked questions about healthcare for seniors, which will address common concerns and provide further guidance on accessing and affording healthcare services.

Frequently Asked Questions about Healthcare for Seniors

How to qualify for home health care under Medicare?

To qualify for home health care under Medicare, seniors must meet specific criteria. First, a doctor must certify that the individual needs intermittent skilled nursing care, physical therapy, or speech-language pathology services. Additionally, the senior must be homebound, meaning leaving the home is a significant effort. Medicare Advantage plans often include extra benefits that can cover additional services, making them a popular choice for those seeking comprehensive care options.

Medicare also covers preventive services like flu shots, cancer screenings, and annual wellness visits. These services are crucial for seniors to maintain their health and catch potential issues early.

What is the cheapest health insurance for senior citizens?

Finding the cheapest health insurance for senior citizens involves comparing different plans and understanding the costs associated with each. Medicare Part A is free for most seniors, while Part B requires a premium. For those looking for more coverage, Medicare Advantage plans can be a cost-effective option. These plans often have lower premiums compared to traditional Medicare with supplemental insurance, but they may come with network restrictions.

It’s essential to consider out-of-pocket costs, such as deductibles and co-pays, when comparing plans. Seniors should evaluate their healthcare needs and financial situation to determine the most affordable option.

How can seniors access free healthcare services?

Seniors can access free healthcare services through various government programs and community resources. Medicaid provides free or low-cost healthcare for eligible low-income seniors. The eligibility criteria vary by state, but it typically includes both income and asset limits.

Community resources, such as local health departments and senior centers, often offer free or low-cost services. These may include health screenings, vaccinations, and educational programs. Additionally, many areas have nonprofit organizations dedicated to helping seniors access the care they need.

For seniors who qualify, extra help is available for prescription drug costs through programs that reduce co-pays and deductibles. These resources can significantly lower healthcare expenses for those on a tight budget.

By exploring these options, seniors can find ways to access necessary care without financial strain. Understanding the available resources and programs can empower seniors to make informed decisions about their healthcare needs.

Next, we will conclude with a look at how Sun Towers Retirement Community provides comprehensive care and senior living options custom to meet the diverse needs of seniors.

Conclusion

At Sun Towers Retirement Community, we believe in providing comprehensive care that evolves with our residents’ needs. Our continuum of care ensures that seniors can enjoy their golden years with peace of mind, knowing they have access to the support they need, when they need it.

Located in Sun City Center, FL, we offer a variety of senior living options designed to cater to different levels of independence and care requirements. Whether you’re looking for independent living, assisted living, or more specialized services like memory care and skilled nursing, Sun Towers has a place for you.

Our goal is to create a community where seniors can age in place comfortably. This means offering a range of healthcare services right on site, from regular check-ups at our physician’s clinic to more intensive care options. Our residents have the assurance that they won’t have to move as their care needs change.

Moreover, we understand the importance of an active and fulfilling lifestyle. That’s why we provide a rich array of activities and amenities that promote physical, mental, and social well-being. From fitness programs to social gatherings, we aim to keep our residents engaged and happy.

Choosing the right retirement community is a big decision, and we are committed to making that choice easier by offering personalized care plans and a supportive environment. Our team is here to ensure that you or your loved one receives the highest quality care custom to individual needs.

For more information about our skilled nursing facilities and other services, visit our Skilled Nursing Facilities page.

At Sun Towers, we are dedicated to enhancing the quality of life for seniors, providing a home where they can thrive. Come visit us and see how we can make your retirement years truly golden.